In today’s digital age, an AI app for stock market trading is revolutionizing how traders analyze data, predict market trends, and execute trades efficiently. With artificial intelligence transforming industries worldwide, investors are leveraging AI-powered stock market apps to make data-driven decisions. These apps use machine learning, predictive analytics, and real-time market data to provide users with cutting-edge insights.

An AI app for the stock market functions by analyzing massive datasets, recognizing patterns, and offering predictions. The primary goal is to optimize trading strategies and minimize risks. Traditional stock market analysis relies on human expertise, but AI automates this process, making it faster and more accurate.

AI stock market apps utilize advanced algorithms to scan multiple financial indicators, including historical price trends, market sentiment, economic reports, and global financial news. The ability to process vast amounts of data in real time gives traders a competitive edge.

Key Features of AI Apps for the Stock Market

An AI app for the stock market integrates various features that enhance trading efficiency. These include:

-

Predictive Analytics: AI algorithms analyze past stock performances to forecast future price movements.

-

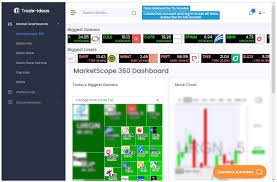

Real-Time Market Updates: Instant stock price updates and breaking news help traders make timely decisions.

-

Sentiment Analysis: AI scans financial news, social media, and investor sentiments to gauge market trends.

-

Algorithmic Trading: Automated trading bots execute trades based on predefined parameters.

-

Portfolio Management: AI apps optimize investment portfolios, balancing risks and returns.

-

Risk Assessment: AI evaluates potential risks before executing trades, reducing financial losses.

How AI Apps Improve Stock Market Trading

The AI app for stock market trading is reshaping investment strategies. AI-driven apps help traders eliminate emotional decision-making, ensuring objective and logical trading. With AI’s ability to analyze thousands of stocks simultaneously, traders receive precise recommendations, making investments more profitable.

AI-powered trading apps provide a distinct advantage by reducing human errors. AI models continuously learn from past trends, refining predictions and adapting to market changes. These intelligent systems alert traders to profitable opportunities while warning against potential losses.

Benefits of Using an AI App for the Stock Market

The adoption of an AI app for stock market trading offers numerous benefits:

-

Data-Driven Decision-Making: AI processes vast amounts of data, giving traders well-informed insights.

-

Speed and Efficiency: AI executes trades faster than humans, ensuring optimal trade timing.

-

24/7 Market Monitoring: AI keeps track of global stock markets, identifying trends and opportunities.

-

Improved Accuracy: AI algorithms minimize risks by predicting price fluctuations with high accuracy.

-

Customizable Trading Strategies: AI apps allow traders to set personalized investment parameters.

AI Trading vs. Human Trading

The AI app for stock market trading surpasses human trading in several ways. AI eliminates biases, emotions, and impulsive decision-making, ensuring consistent trading strategies. While human traders rely on experience and intuition, AI depends on data-backed predictions.

However, AI cannot replace human oversight entirely. The best approach involves using AI to enhance human decision-making rather than replacing it. Traders who integrate AI into their strategies gain a significant advantage over traditional investors.

The Role of Machine Learning in AI Stock Market Apps

Machine learning is a core component of an AI app for stock market trading. These algorithms analyze massive amounts of financial data to identify patterns and predict stock price movements.

Key machine learning techniques used in stock market apps include:

-

Supervised Learning: AI models are trained on historical stock data to predict future price trends.

-

Unsupervised Learning: AI identifies hidden patterns and correlations in market data without human intervention.

-

Reinforcement Learning: AI trading bots learn from past trades and improve strategies over time.

By leveraging these techniques, AI-powered stock market apps continuously enhance their forecasting accuracy, helping traders make better investment decisions.

AI-Powered Trading Bots

The AI app for stock market trading often includes trading bots. These bots operate based on preset conditions, executing trades automatically. AI trading bots identify lucrative trade opportunities, reducing human involvement while increasing efficiency.

AI trading bots analyze historical data to recognize profitable trading patterns. These automated systems adjust strategies based on real-time market conditions. Unlike human traders, AI bots operate 24/7 without fatigue, ensuring continuous trading.